A Second Charge Mortgage can be a good way to borrow against residential, buy to let, consumer buy to let and HMO property. So, if you are struggling to satisfy a client’s borrowing needs, maybe you do not want to disturb their existing mortgage deal or their circumstances have changed and a re-mortgage is not viable, then consider a second charge. Our lenders take a more flexible approach to underwriting and we have some great products available.

Overview

- Residential, Buy to Let and HMO

- Non-standard property type and construction

- All credit profiles considered, even missed / late payments on loans, credit cards and mortgages, accounts that are in default, outstanding CCJs, in a Debt Management Plan, even Discharged Bankrupts

- Flexible income ratios

- Any legal purpose, including debt consolidation, home improvements, property purchase / deposit, tax bill and lease extension

- 100% LTV

- Mortgages from £10,000

- Max age 85

- Fast completion

- Fixed Rates, Trackers and Interest Only

- Joint Applications accepted even when the Deeds or main mortgage are in sole name

For all Second Charge Mortgage enquiries, please call our team of experts on 0800 032 9595 or you can send us more details using our Enquiry Form and we'll call you. Alternatively, you can obtain an indicative online quote here.

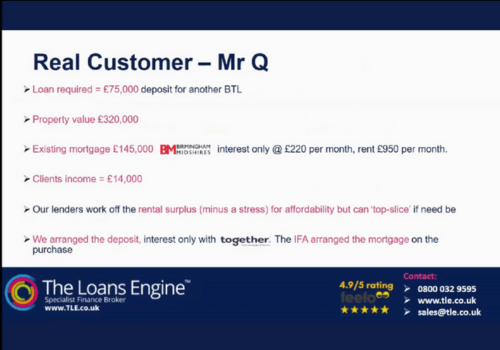

An example of a second charge BTL case study

What we can offer

A lender panel that is whole of market

Low Rate Trackers and Interest Only

Free Product Sourcing and Mortgage Advice (if required)

You can control your earnings

View Product Matrix

View Product Matrix